by Timothy Smith

Sales Associate

Timothy.Smith1@cbrealty

(530)360-1295

From Renter to Homeowner: Why This Year Is

Your Moment in Arizona

As the Arizona Real Estate market continues to shift, one question keeps surfacing: Should I keep renting, or is it finally time to buy a home?

Let’s break it down to what makes the most sense, dollars, and long term wealth.

According to the data, a homeowner who bought their property in January 2021 paid approximately $205 per square foot. Fast forward four years, and that home has increased in value by 29%.

If the same trend continues, a home purchased today for $375,000 could be worth around $483,750 in just four years.

With a 20% down payment and consistent monthly payments, you could build nearly $200,000 in equity over that time.

That’s like putting $50,000 back into your own pocket every year, just by living in your home.

Renting vs. Owning: Monthly Payment Comparison

Let’s say you’re paying $2,000/month in rent for a modest 3-bedroom in Phoenix. That money covers your landlord’s mortgage, property taxes, and equity gains.

Now compare that to owning:

-

Home Price: $375,000 (median in Arizona)

-

Down Payment: As low as 3.5% with assistance = $13,125 (Higher Down Payment Results in Lower Monthly Payment)

-

Loan Type: 30-year fixed

-

Interest Rate: 6.75% (varies)

-

Monthly Payment (PITI): $2,271/month*

Sure, it’s slightly higher—but it’s an investment in YOU:

-

Build equity with every payment.

-

Enjoy stable monthly costs (no surprise rent hikes).

-

Benefit from tax deductions on mortgage interest.

-

Watch your home appreciate in value over time.

In 5 years, a homeowner could gain over $70,000 in equity, while a renter gains approximately $0. See Chart

*Based on a 20% Down Payment.

What About the Down Payment? Arizona’s Got You Covered.

Many first-time buyers believe a 20% down payment is required. It’s not.

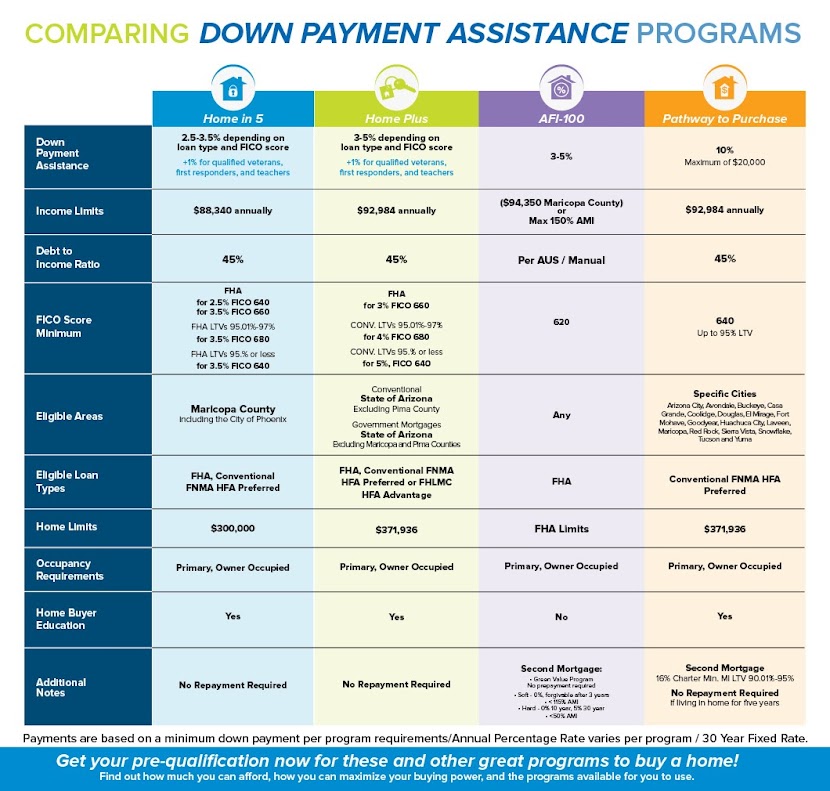

Arizona offers several down payment assistance (DPA) programs, including:

-

Home Plus Program: Up to 5% in down payment/closing cost assistance. No repayment after a few years of ownership.

-

Pathway to Purchase (P2P): Up to $20,000 in select cities.

-

AZ HERO Program: Tailored for teachers, first responders, nurses, and military members.

-

Chenoa Fund + FHA Loans: Allow 3.5% down—assistance available.

Most of these programs are income-based, location-specific, and can be combined with FHA, VA, or conventional loans.

Why Now Is the Best Time to Buy

-

Rates Are Expected to Drop: As interest rates begin trending downward, more buyers will re-enter the market—driving competition and prices up again. Buying before that happens puts you in a stronger position. Additionally, If rates were to rise even higher you have now locked in a cheaper rate

-

Less Competition Right Now: You can negotiate better deals, seller credits, and closing cost help.

-

Home Prices Are Stabilizing: Arizona's market is correcting itself, creating opportunities to buy below peak values.

-

Refinance Later: You marry the house, date the rate. You can always refinance when rates fall—but you can't go back and buy a home at today’s price.

Renting might feel easier in the short term, but owning builds long-term wealth and stability, especially with Arizona’s generous assistance programs.

If you’re paying $2,000/month or more in rent, it’s time to ask:

“Would I rather pay my landlord’s mortgage, or my own?”

Timothy Smith | Sales Associate

timothy.smith1@cbrealty.com

(530)360-1295